Investing money is an important topic that concerns many people. There are many ways to invest your money, but not all of them are equally safe or profitable. One popular form of investing money is ETF savings plans and P2P loans. Both have their advantages and disadvantages and are suitable for different types of investors.

Investing wisely requires a thorough analysis of one’s risk tolerance, goals and needs to develop a balanced and diversified investment strategy.

Why should I invest?

Investing can be a great way to grow your wealth over time. By putting your money into assets such as stocks, bonds, or real estate, you can earn a return that outpaces inflation and helps you build wealth. Additionally, investing can also help you diversify your portfolio and spread out your risk.

Investing in the stock market, for example, can be a great way to earn a higher return on your money than you would by keeping it in a savings account. Historically, the stock market has delivered an average annual return of around 10% over the long term. While there are certainly risks involved, over time these risks tend to smooth out, and investing in a diversified portfolio can help to minimize them.

Additionally, investing can also help you achieve your financial goals, whether it’s saving for a down payment on a house, paying for your child’s education or building a nest egg for retirement. Investing can help you reach these goals faster than if you simply saved money in a low-interest savings account.

Another benefit of investing is that you can take advantage of compounding. When you earn interest or dividends on your investments, those earnings are then reinvested and can earn more interest or dividends. Over time, this can lead to exponential growth in your investments.

Overall, investing can be a great way to grow your wealth, achieve your financial goals, and build a secure financial future. It’s important to do your research and understand the risks involved, but with the right approach, investing can be a powerful tool for achieving financial success.

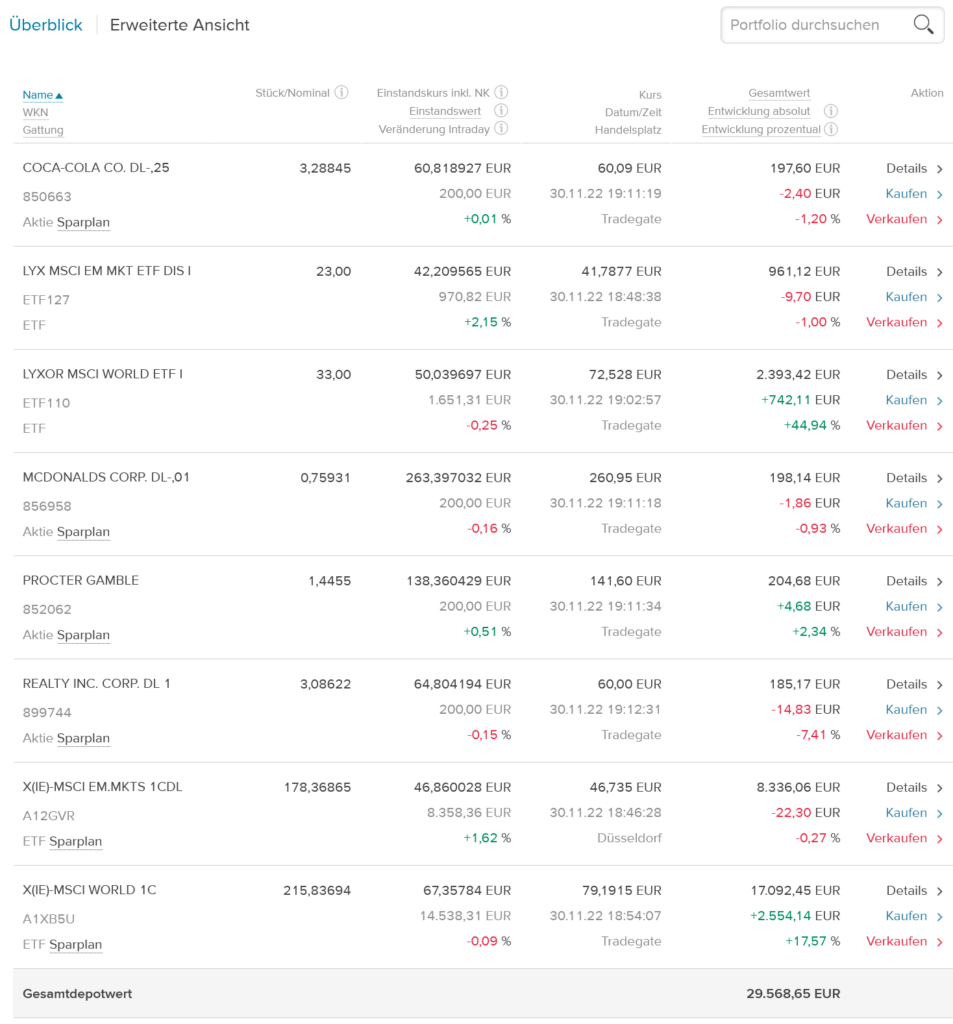

Investing with ETF Savings Plans

ETF savings plans, also called exchange traded funds, are a simple and cost-effective way to invest in the stock market. They track an index, such as the DAX, and thus offer a broad diversification of the investment.

ETF savings plans are particularly suitable for beginners, as they offer an easy entry into the stock market, and you do not have to invest a lot of money at once.

Another advantage of ETF savings plans is that they can be purchased cost-efficiently on a regular basis. By buying small amounts at regular intervals, the risk of losses from buying at an inopportune time is minimized.

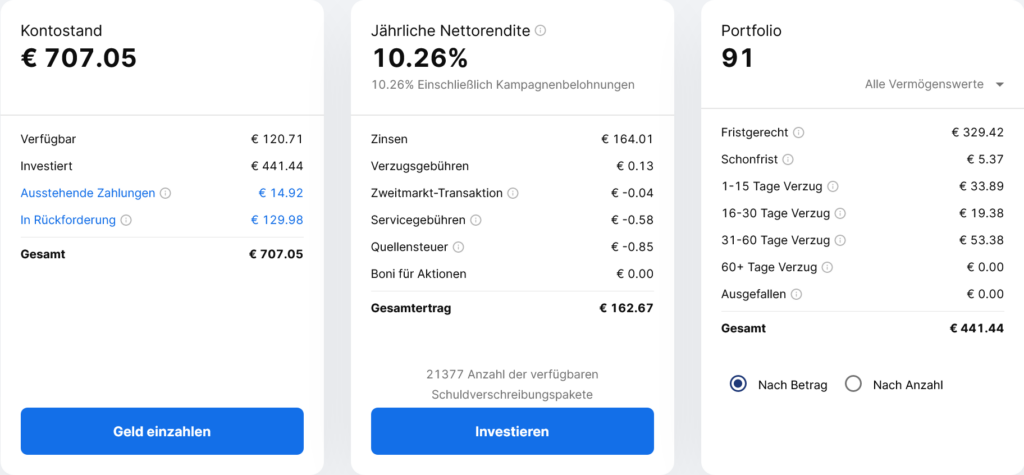

Investing in P2P loans

P2P loans, also known as peer-to-peer loans, are a form of investment in which people invest directly in loans from private individuals. P2P* loans offer investors a higher return than conventional forms of savings such as overnight money or time deposits, but the risk is also higher.

P2P loans are particularly suitable for investors who are willing to take a higher risk and who want to invest their money in short-term projects. However, it is important to note that P2P* loans are not protected and losses may occur in case of insolvency of the borrower.

Another advantage of P2P loans is that they are invested directly in specific projects and thus have a social component. By financing projects that would otherwise not receive funding, one can also make a positive contribution to society.

You want to get 5 EUR starting credit at Bondora?

Than register now >>>HERE<<< and get

5 EUR starting credit and after investing you’ll get another 5 EUR after 30 days.

Note the risk!

Overall, ETF savings plans and P2P* loans are both attractive forms of investment, but they offer different risks and returns. ETF savings plans are suitable for investors who are looking for a broad diversification of the investment and an easy entry into the stock market. P2P* loans, on the other hand, are suitable for investors who are looking for a higher return and are willing to take a higher risk.

Apple MacBook Air (15", Apple M4 Chip mit 10‑Core CPU und 10‑Core GPU, 16GB Gemeinsamer Arbeitsspeicher, 256 GB) - Himmelblau

1.299,00 € (as of 24. April 2025 09:30 GMT +02:00 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)If you decide to use ETF savings plans, you should find out in advance about the different providers and the indices they track. It is important that you choose an ETF that meets your investment objectives and performs well. Likewise, they should keep an eye on the cost (TER).

If you choose P2P loans, you should find out about the different platforms and their default rates. It is important that you choose a platform that has a good reputation and offers high credit quality.

It is also important to note that neither form of investment is guaranteed and there is always some risk. Before choosing an investment option, always do thorough research and consider your personal investment goals and risk tolerance.

Another option for investing your money is a combination of ETF savings plans and P2P loans. By combining the two types of investments, you can minimize risk while reaping the benefits of both.

In conclusion, ETF savings plans and P2P loans are both attractive forms of investment suitable for different types of investors.

It is important to thoroughly inform yourself in advance and consider your personal investment goals and risk tolerance before deciding on an investment form.

A combination of both types of investments can be a good way to minimize risk while benefiting from the advantages of both. Invest wisely and diversify your portfolio to achieve optimal returns and minimize risk.

Leave a Reply